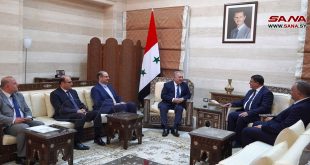

Damascus, SANA – Governor of the Central Bank of Syria (CBS) Adib Mayyaleh on Tuesday discussed with directors or private banks in Syria issues related to the bank sectors, primarily the issue of overdue debts due to banks and how to collect them.

Mayyaleh said that the system for classifying debt risk will be revised after taking the suggestions of banks and the effects of the crisis into consideration, adding that this should help reduce the number of bad loans and encourage clients to schedule and settle their debts to improve their credit ratings.

He asserted that the next stage will witness a positive shift in the economic investment environment in Syria, and that the crisis is a phase that will pass with perseverance and unified efforts.

The meeting also discussed investments abroad, the role of banks in foreign trade, foreign currency trade, and increasing bank capitals, among other issues, in addition to studying suggestions and ideas proposed by bank directors.

Hazem Sabbagh

Syrian Arab News Agency S A N A

Syrian Arab News Agency S A N A